Securities industry firms have to comply with SEC rules and regulations in order to ease the protection of investors, maintain fair and orderly markets, and provide full and fair disclosure regarding their activities.

Organizations need to put into place relevant policies and controls to avoid potential monetary, legal, and reputational impact.

In this article, we explore practical ways to meet SEC compliance requirements, helping companies build a robust compliance program that aligns with regulatory expectations and minimizes risk.

What Does SEC Compliance Mean?

Most of the SEC rules are binding on companies and cover proper registration and reporting requirements for the public offering of securities from companies, adequate and timely disclosures to investors in companies providing securities, and the proper governance and operations of companies.

These rules govern public companies, broker-dealers, investment advisers, and other professionals involved in the business of securities, with other entities.

Regulation of securities trading, prevention of fraud, and assurance of fair and transparent operation of the securities markets are the requirements.

Start with a Strong Compliance Program

A well-designed compliance program is the foundation of meeting SEC requirements.

It should include:

- Written policies and procedures tailored to the company’s business model and risks.

- Clearly defined roles and responsibilities for compliance officers and management.

- Regular employee training on SEC rules and compliance obligations.

- Mechanisms for monitoring, reporting, and addressing compliance issues.

A culture of compliance should be fostered throughout the organization, where teams understand the importance of regulatory adherence and feel empowered to speak up about potential issues.

Key Areas to Focus On

Financial Reporting and Disclosure

These companies also must report exhaustively and periodically, like when they file annual 10-K filings and quarterly 10-Qs, including when they disclose the company’s financial condition and its risks in a timely, full, and fair way.

Risk Management and Cybersecurity

Companies use strong processes for the management of risk.

Companies use these processes to identify risks.

They use them to assess risks.

They use them to manage risks in operations, markets, and technologies.

They use them to manage risks in operations, markets, and technologies.

Given the rise in cyber-attack threats, companies should, for example:

- Implement cybersecurity risk management programs.

- Monitor for material cybersecurity incidents.

- Disclose cybersecurity risks and incidents promptly and accurately.

This proactive approach is critical as investors demand greater transparency about cyber resilience.

Third-Party and Vendor Oversight

Similar requirements for compliance programs also apply to third parties (e.g., service providers, technology vendors).

Companies need to do vendor due diligence, enter into contracts with compliance obligations, and monitor compliance.

Governance and Oversight

Active engagement of the board of directors and senior management in compliance governance and in overseeing risk and control effectiveness is vital to a strong governance framework.

Documenting these governance actions builds regulatory trust.

Practical Ways to Meet SEC Compliance Requirements

Here are actionable steps organizations can implement:

- Conduct Regular Compliance Reviews

Periodic program assessments help identify gaps and ensure policies stay current with evolving regulations. - Keep Meticulous Documentation

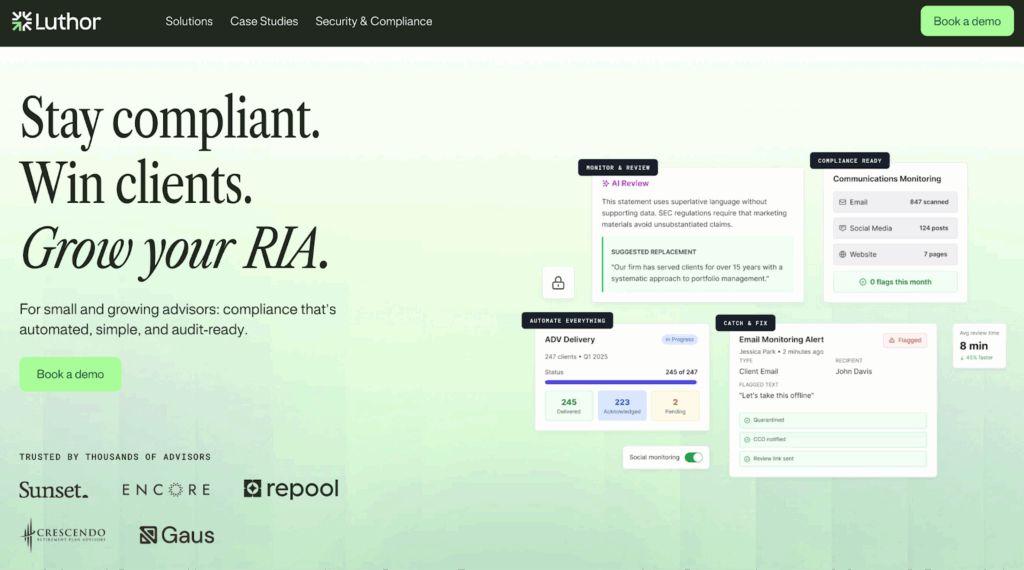

Maintain clear records of compliance activities, monitoring results, training sessions, and remediation efforts. - Integrate Technology Solutions

Use compliance management platforms to automate workflows, track deadlines, and generate audit trails efficiently. Platforms like Luthor.ai can assist in simplifying compliance workflows by leveraging AI-driven tools. - Train Employees Frequently

Ongoing education across departments ensures everyone understands their roles related to SEC rules. - Implement Incident Response Plans

Prepare for possible risks like data breaches by establishing protocols for swift action and notification. - Self-Monitor and Self-Report

Encourage early detection of issues and voluntary disclosures to regulators to demonstrate accountability. - Update Policies Proactively

Stay informed of regulatory changes and adapt policies promptly to remain compliant.

Maintaining a Culture of Compliance

Foster transparency.

Reward reporting of issues.

Incentivize compliance.

Use compliance metrics to inform managerial decisions.

Embed regulatory culture into the organization’s DNA.

This action helps avoid violations and win goodwill from regulators through showing that the company is sincere.

Conclusion

Also, companies may help ensure they effectively comply with SEC rules when they periodically review and refine compliance protocols, document procedures, invest in new technology, and train employees.

If governance is structured strongly and people comply, that may also assist the development of effective compliance programs.

Advanced compliance tools such as Luthor.ai can help in streamlining and improving regulation for organizations.

Such realistic approaches to SEC compliance allow the organization to better meet the requirements, protect investors, reduce risk, and promote long-term organizational success.